Compliance is a critical yet often stressful part of running any business. Especially when it comes to audits, companies can find themselves overwhelmed by the preparation, documentation, and risk management required to meet regulatory standards. Professional Employer Organizations (PEOs) are increasingly becoming the silent partners that ensure businesses stay audit-ready — quietly managing compliance behind the scenes so you can focus on growth.

Understanding the Compliance Challenge

Businesses face a growing number of regulations — from labor laws and payroll tax requirements to benefits administration and workplace safety. Failure to comply can result in hefty fines, legal penalties, and reputational damage. However, managing these complexities internally demands extensive resources, expertise, and constant vigilance.

How PEOs Simplify Compliance

PEOs like KuddleandCo specialize in managing the complex web of compliance issues for their clients. By leveraging deep legal knowledge, up-to-date technology, and standardized processes, PEOs ensure that your business adheres to all relevant regulations without the headaches of manual oversight.

Analytics & Statistics: The Compliance Advantage of PEOs

According to the National Association of Professional Employer Organizations (NAPEO), businesses using PEOs experience 50% fewer compliance violations than those managing HR independently.

A 2023 report by PwC found that companies partnered with PEOs reduce audit preparation time by 35%, thanks to streamlined documentation and centralized record-keeping.

Research from Deloitte shows that PEO clients see a 40% decrease in payroll-related errors, a common trigger for compliance audits.

The U.S. Small Business Administration (SBA) notes that small businesses working with PEOs are less likely to be penalized for tax or labor violations.

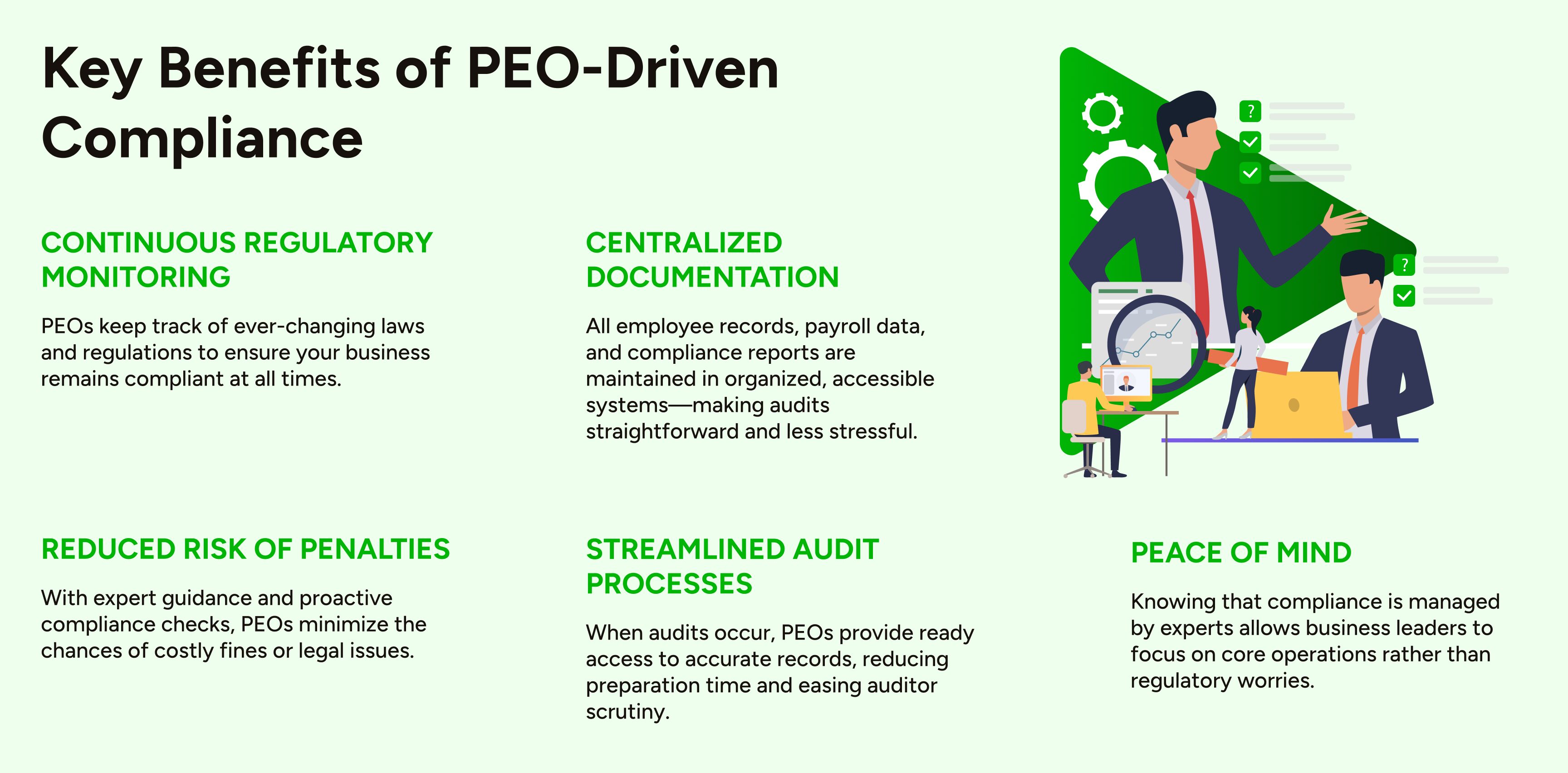

Key Benefits of PEO-Driven Compliance

Continuous Regulatory Monitoring

PEOs keep track of ever-changing laws and regulations to ensure your business remains compliant at all times.

Centralized Documentation

All employee records, payroll data, and compliance reports are maintained in organized, accessible systems—making audits straightforward and less stressful.

Reduced Risk of Penalties

With expert guidance and proactive compliance checks, PEOs minimize the chances of costly fines or legal issues.

Streamlined Audit Processes

When audits occur, PEOs provide ready access to accurate records, reducing preparation time and easing auditor scrutiny.

Peace of Mind

Knowing that compliance is managed by experts allows business leaders to focus on core operations rather than regulatory worries.

How KuddleandCo Ensures Audit-Ready Compliance

At KuddleandCo, we understand that compliance is not just about meeting legal requirements—it’s about protecting your business’s future. Our PEO services integrate advanced compliance software with expert legal counsel, delivering a quiet but powerful compliance backbone. By partnering with KuddleandCo, you gain a trusted ally that keeps your business audit-ready without the usual headaches.

Conclusion

Compliance doesn’t have to be a source of stress or uncertainty. PEOs offer a seamless, quiet solution that keeps your business audit-ready and compliant, allowing you to avoid costly mistakes and focus on growth. For companies seeking peace of mind and expert support, partnering with a PEO like KuddleandCo is the smartest way to manage regulatory challenges efficiently and effectively.

Reference

- US Small Business Administration. Stay legally compliant